How to Get Your National Tax Number (NTN) in Pakistan?

Getting your National Tax Number (NTN) is an essential step for managing your tax obligations in Pakistan. Here’s how you can easily obtain your NTN. You can obtain your NTN by registering on the FBR IRIS portal. The FBR IRIS portal is an online system the Federal Board of Revenue (FBR) provides for tax registration and filing.

You can obtain your NTN by registering on the FBR IRIS portal.

The FBR IRIS portal is an online system provided by the Federal Board of Revenue (FBR) for tax registration and filing.

Once you register, the FBR will assign you an NTN and provide you with a username and password.

With your NTN, username, and password, you can log into the FBR portal to file your tax returns and manage other tax-related activities.

By following these steps, you can easily obtain your NTN and gain access to the FBR portal for all your tax filing needs.

Types of National Tax Number (NTN)

There are three types of NTN in Pakistan. Here’s a quick overview:

1. Personal NTN

This type of NTN is issued by the FBR on the CNIC of a person. It applies to both salaried and business individuals. You can easily check it through the FBR online portal. After registering your FBR profile, you can also add a sole proprietorship business separately.

2. Association of Persons (AOP) / Partnership NTN

This type of NTN is for an Association of Persons (AOP). An AOP is formed by at least two partners. You can verify this type of NTN using the online inquiry system.

3. Company’s NTN

When a company is registered, the Securities and Exchange Commission of Pakistan (SECP) issues a registration or incorporation number. This number can be used to check the company’s NTN on the FBR portal.

Online NTN Inquiry

Many people find it challenging to check their tax status online, but there’s no need to worry! We’ve got you covered with a simple guide. In today’s world, online services make things easier for everyone. Similarly, online NTN inquiries make it convenient for both individuals and businesses to verify their tax status, ensuring everything is accurate for tax compliance.

While NTN verification can also be done through specific bank branches or agents, the online method is much more convenient and accessible for most people.

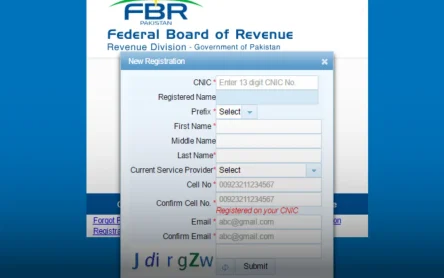

Online NTN Verification by CNIC

The Federal Board of Revenue (FBR) makes it easy for individuals to verify their NTN (National Tax Number) online using their CNIC. Here’s how you can do it:

- Visit the FBR e-portal at https://e.fbr.gov.pk.

- On the left menu bar, choose “Taxpayer Profile Inquiry.”

- To verify your NTN, select either ‘NTN’ or ‘CNIC’ from the “Parameter Type” section. If you are a foreigner, select “Passport No” instead. For companies, choose “Comp/Reg No.”

- Enter your 13-digit CNIC number in the “Registration No” field.

- Type in the CAPTCHA code shown on the screen.

- Click “Verify” to view your tax information.

NTN Verification through SMS

You can also verify your NTN via SMS:

- For individual taxpayers, type “ATL [space] 13-digit CNIC number” and send it to 9966.

- For AOPs and companies, type “ATL [space] 7-digit NTN number” and send it to 9966.

NTN Verification Charges

There are no charges for online verification. However, if you use SMS, your service provider may charge a small fee.

Benefits of NTN Inquiry

You might wonder why you should bother with NTN verification. Think of it as a checkup for your tax ID. Verifying your NTN offers several benefits for both individuals and businesses:

- Transparent Financial Transactions: It ensures clarity in your financial dealings.

- Tax Matters in Order: Keeps your tax-related affairs properly managed.

- Avoid Legal Issues: Helps you steer clear of future legal troubles due to non-compliance.

- Legal and Tax Compliance: Ensures you meet all legal and tax requirements.

- Financial Opportunities: Opens doors to credit facilities and business opportunities.

- Access to Financial Services: Makes it easier to avail various financial services.

How to Change Your National Tax Number (NTN)

If you need to amend your NTN, follow these steps based on whether you are an individual or a business:

1. Individual Change

- Log in to the IRIS FBR portal.

- Click on “Registration” from the menu bar.

- On the left side, select “81 (Form of Registration filed for modification).”

- Make the necessary changes in the form according to your requirements.

2. Company/AOP Change

If a Company or AOP is not registered for sales tax only, they can amend their NTN using the following procedure:

- Log in to the IRIS FBR portal.

- Click on “Registration” from the menu bar.

- On the left side, select “81 (Form of Registration filed for modification).”

- Make the necessary changes in the form according to your requirements.

Required Documents for NTN Amendments

Depending on the change, you may need to provide:

- Change of Address: Form 21 and Lease agreement for a company.

- Change in Partnership Structure: Updated profit-sharing ratio.

- Other Material Changes: Updated partnership deed, if applicable.

For companies or AOPs registered for sales tax, amendments require a visit to the Regional Tax Office (RTO).